Acquirements

- How projects are completed

- Credit process management

- Risk management in project finance

- Project financial analysis fundamentals

Tutors

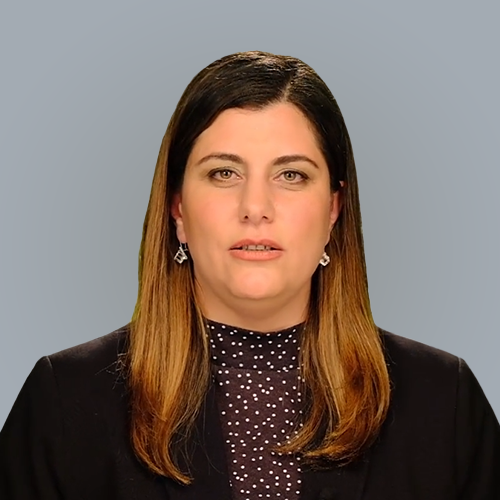

Özlem Kıldır

General Manager and Founder- Profinstance Project Finance Consultancy and Training Services

Course Content

5 chapters14 videos3 hour 2 minute total time

Introduction

- Introduction01:23

Fundamentals of Project Finance

- Fundamentals of Project Finance15:41

- Differences Between Project Finance and Corporate Finance08:52

- Parties Involved in Project Finance11:53

- Interparty Contracts and Characteristics in Project Finance19:03

- Project Finance Process02:37

- Market Sizes in Project Finance04:55

Risk Analysis and Risk Management in Project Finance

- Risk Analysis and Risk Management in Project Finance16:55

- Risk Analysis and Matrix Formation06:37

- Risk Mitigation Methods in Project Finance16:07

- Consultants Involved in Project Finance Structure16:08

Financial Evaluation of Project Finance

- Financial Evaluation of Project Finance23:34

Credit Assessment of Project Finance

- Principles of Credit Assessment for Project Finance27:48

- Credit Assessment Process for Project Finance10:31