Acquirements

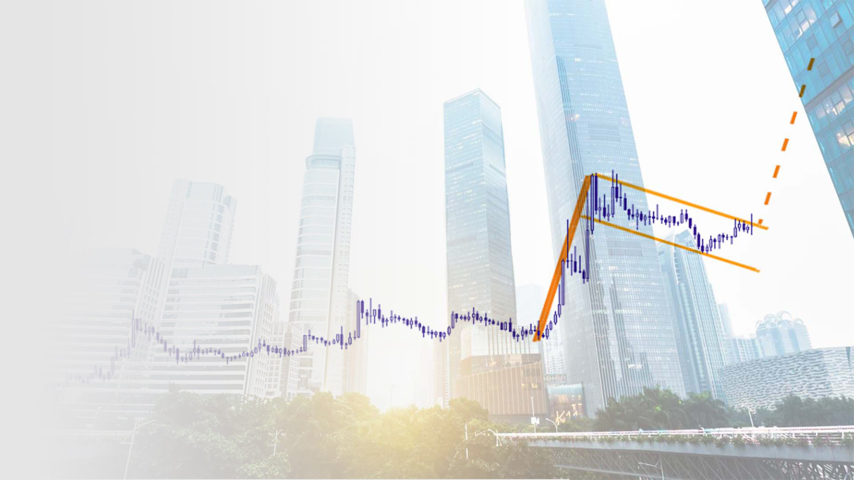

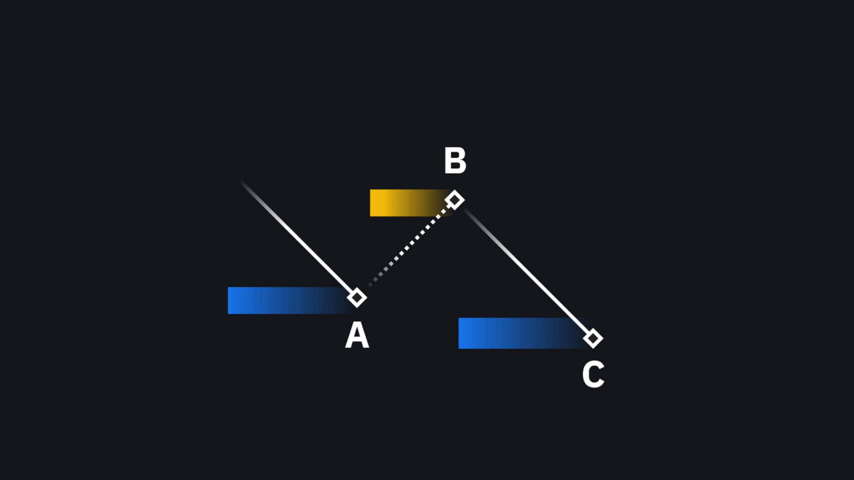

- Basic terms of the formation

- Price range estimate

- Ability to analyze graphics

- Choosing the right investment instrument

Tutors

Ahmet Mergen

Strategist

Course Content

2 chapters4 videos23 minute total time

Introduction

- Introduction and Rectangle Formation05:38

Example Charts and Explanations

- Example Charts and Explanations 105:53

- Example Charts and Explanations 205:55

- Example Charts and Explanations 305:39