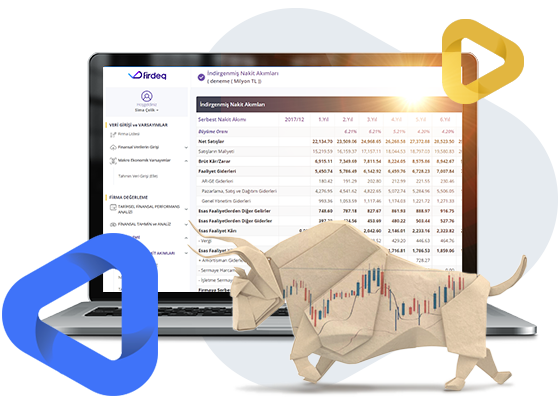

Evaluate the Company You Want

Whether publicly traded or not, operating in industrial or financial sectors, you can easily value the company you desire using widely accepted methods such as discounted cash flows, relative valuation (market multiples), excess return valuation, Gordon growth model, dividend discounting, and net asset value.

Measure Companies' Performances and Risks

By employing techniques like comparative table analysis, vertical percentage analysis, trend analysis, and ratio analysis, you can evaluate the financial performance of the selected company. Additionally, based on the financial statement data, you can monitor the system-generated estimated credit rating score, keeping track of the company's insolvency risk and creditworthiness developments, enabling you to assess the company's progress more effectively.

Forecast Financial Performance

Within the framework of your assumptions about the company's future, you can create short, medium, and long-term financial forecasts, constructing estimated income statements, balance sheets, free cash flow statements, and financial ratios. With the aid of projected financial data and ratios, you can visualize where companies might stand financially in terms of risk, profitability, and growth in the coming years.